The 50/30/20 Budget Rule – The Simple Explain with Calculator

Managing your money doesn’t have to be complicated. The 50/30/20 budget rule is a widely recognized method for budgeting that simplifies financial planning into three clear categories: needs, wants, and savings. Whether you’re just starting out or looking to refine your spending habits, understanding this rule can transform how you handle your finances. In this article we will define you how to make this budget rule work and the end of this article you can get a free template, that you can use to manage your finance and achieve your financial goal.

What is 50/30/20 Budget Rule

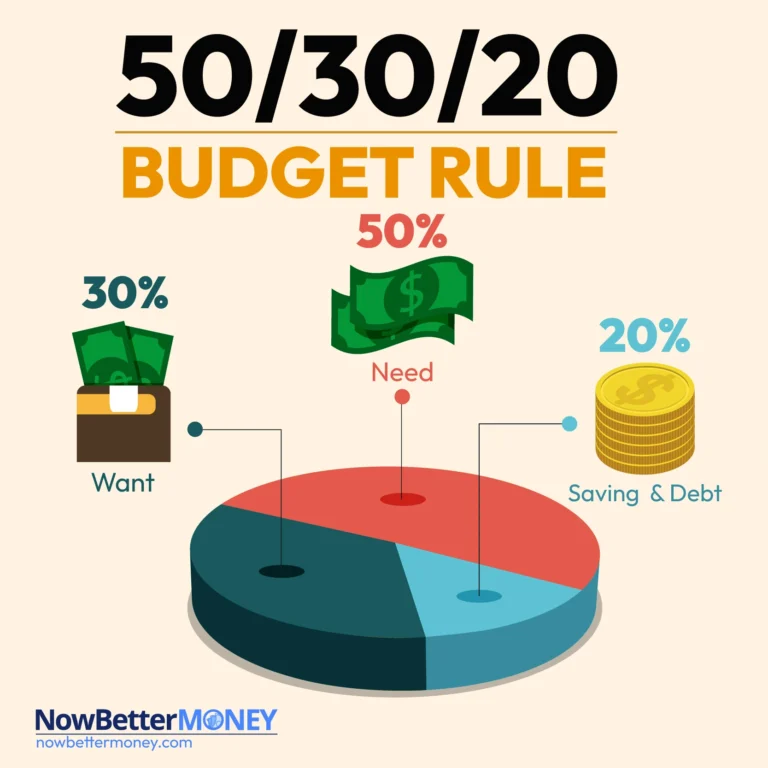

The 50/30/20 budget rule is a simple and popular method for managing your money. It divides your after-tax income into three broad categories:

50/30/20 Budget Calculator

The budget calculator below shows how your income could be split using the 50/30/20 rule.

Input that number in the budget calculator to see how to divide your money into the three main categories.

50/30/20 Budget Rule Calculator

Split your take-home income into 50% Needs, 30% Wants, and 20% Savings/Debt.

How to create 50/30/20 Budget

Step 1: Calculate Your Monthly After-Tax Income

Step 2: Divide Your Income into the Three Categories

Need – 50%

These are essential expenses you must pay each month.

Examples:

Want – 30%

These are non-essential items that improve your lifestyle or enjoyment.

Examples:

Save – 20%

This portion goes toward your financial future.

Examples:

Step 3: Adjust as Needed

Reason Why 50/30/20 Rule Still Important in Budget Planning

The 50/30/20 rule act as important role in the first budgeting layer. Think of budgeting like building a house: you need a strong foundation before adding layers of detail. It sets broad allocations for your money: Needs (50%), Wants (30%), and Savings/Debt (20%). Once the foundation is clear, you can add more precise budgeting methods (like zero-based budgeting) on top.

Why This Is Important:

1. Provides a Clear Starting Point

2. Prevents Overspending Early

3. Makes Advanced Budgeting More Effective

How to Use 50/30/20 More Effective

As i have mention above we can use 50/30/20 as first budgeting layer and then you can add more precise budgeting methods, like zero-based budgeting on top. Here is the most effective way to make a budgeting much more clearly.

Step 1: Understand the Two Approaches

1. 50/30/20 Rule:

2. Zero-Based Budgeting:

3. Why combine them:

Step 2: Calculate Your Income

Step 3: Allocate by 50/30/20 Percentages

|

Category |

Percentage |

Amount |

|---|---|---|

|

Needs |

50% |

$1,500 |

|

Wants |

30% |

$900 |

|

Savings/Debt |

20% |

$600 |

Step 4: Apply Zero-Based Budgeting Within Each Category

Step 5: Monitor and Adjust

Step 6: Benefits of Combining Both

50/30/20 Budget Template

A 50/30/20 budget template is a simple financial tool that helps you apply the 50/30/20 budgeting rule to your own money. Instead of doing the math from scratch every month, the template organizes your income and expenses into three clear categories

Take control of your money today! Download your FREE 50/30/20 budget template and start planning smarter, not harder. Click the download bellow.

NowBetterMONEY, where is a hub shares practical tips on budgeting, saving, and debt management. I uses a personal finance tracker to monitor spending and savings, helping readers take control of their finances and build long-term financial stability with simple, actionable strategies. Author Bio