How to Make a Budget: 5 Simple Steps for Managing Your Money

You are always want make a budget, but you don’t know how to start or don’t know which method you should choose. This is a normal problem that a beginner always struggle when they want to start make a budgeting. Budgeting is the important part if you want to start manage your money and reach your financial goal. In this blog, I will walk you through a step by step guide to create a personal budget even if you never done before.

1. Understand Your Budget Priority

Before looing to a number, it important to understand your budgeting goal first. When you understand your goal, it is easy for you to set or priority the amount to achieving that goal. When you make a budget without a goal, it is seem you fill a bottle of water by unknow how big the bottle is and how many bottle you have to fill. I hope you understand this this point. Then list down your budget goal:

There are many more goal that you can set for making your budget. Then categories them by it priority. After you can define a clear WHY already, then let go to the step number two.

2. Track Your Income

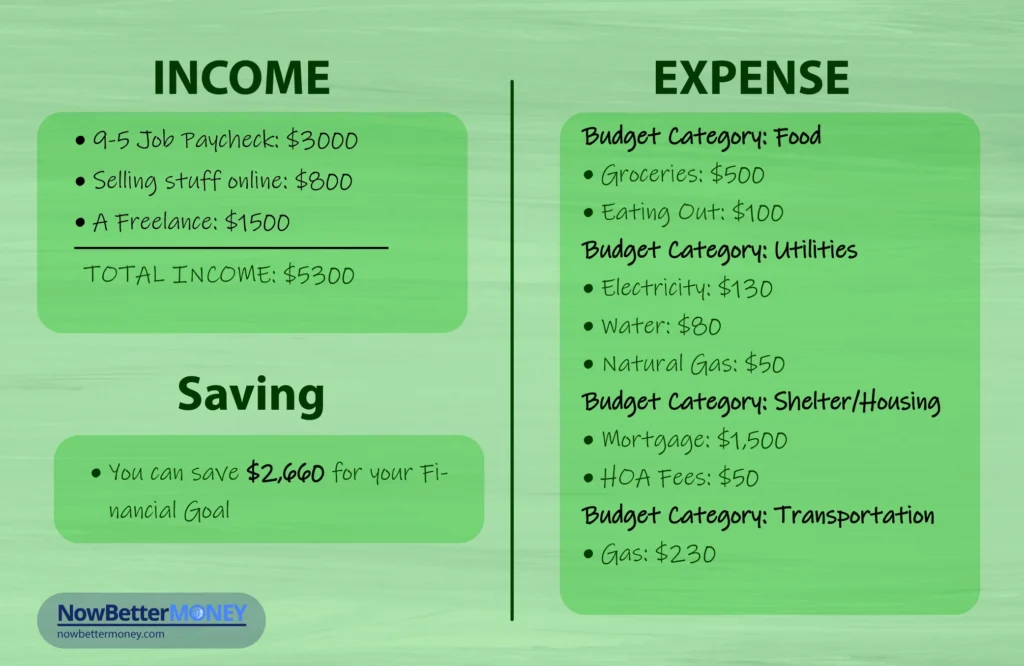

Income is the money that earn from any source every month. Tracking your money is the step you have to do in your budgeting process. The source of money you earn can be through your 9-5 job, your freelance work, your side hustle or anything like that.

Make sure that all the income you write down is “Net Income” (the income after paying tax. Don’t use your “Gross Income” you can’t spend it.

Here is an example of how to list down your income in budgeting:

For someone who have an irregular income, take a look at what you’ve made the last few months and list the lowest amount as this month’s income budget line. If you earn more than amount you list in your budget you can keep it as extra bonus to your budget too.

3. Track Your Expense

The next step you have to consider is money that come out of your wallet. List down all your expense, if you don’t know what are your monthly expense is, let think back to your last month or last month before. Here is an example of most people expense: Electricity Bill; Water Bill; Natural Gas; Mortgage; Petroleum; subscription; cloth, saving, paying debt….

After you list down all your expense, then categorize them as a folder as image shown below. Moreover, all your expense will be has both fixed and variable expense, don’t forget to mark each of them as fixed or variable. Because this will be affect your decision in your budgeting very much when you create a budget plan.

4. Choose Your Budgeting Method

There are many ways to make budget. The important thing that we should consider the most is pick a budget method that work for you.

The 50/30/20 Rule

The 50/30/20 Rule is one of the simplest and most popular budgeting methods. Here’s how it works:

Best for: People who want a quick and easy budgeting method without tracking every expense.

Disadvantage: The 50/30/20 rule is too general for people with tight budgets or high debt. It might not work well if your “needs” take up more than 50% of your income, which is common for low-income earners.

Zero-Based Budget

Zero-Based Budget, you give every dollar a job. If you earn $1,500 a month, you plan how to use all $1,500—so nothing is left unassigned.

You list all your income and all your expenses, including savings and debt payments. In the end, your income minus expenses should equal zero. This doesn’t mean you spend everything—it means every dollar has a purpose.

Best for: People who want full control and are okay checking their budget often. It’s great if you want to be intentional with every dollar.

Disadvantage: It takes more time and effort. You need to track everything closely, which can feel tiring or stressful, especially at the beginning.

Cash Envelope System

Cash Envelope System method is simple but powerful. You take cash and divide it into envelopes for each spending category—like food, gas, or entertainment. When an envelope is empty, you stop spending in that category until the next month.

Best for: People who overspend easily or want a clear, hands-on way to control spending.

Disadvantage: It’s less convenient in the digital world. It’s harder to manage if you shop online, use mobile payments, or don’t feel safe carrying cash.

Pay-Yourself-First Budget

Pay-Yourself-First Budget focuses on saving first. As soon as you get your income, you set aside a fixed amount for savings or debt payments before spending anything else. After that, you use the rest for your needs and wants.

Best for: People who want to grow their savings fast and often forget to save after spending.

Disadvantage: If your income is low or your expenses are already high, it may be hard to save first without missing important bills. You need to be sure your basic needs are covered.

No method is perfect, and that’s okay. You can try one for a month and switch if it doesn’t feel right. You can also mix different methods.

5. Stay Consistence

At the first step, you may think that making budget is hard, because you may forget track your expense, or getting overwhelm to decide for adjusting money to make budget enough. The key is keep going, even if it ‘s a little bit hard, and lean from a mistake that you did from the last month. When you keep going, you will realize by yourself which budget is priority, which one need to adjust to keep you are in budget each month.

Remember! Budgeting is not a LAW that you strictly to follow, but budgeting is an adventure journey that you have to learn and correct month by month.

Bonus Tip: Make Your Budget Before Month Begin

One of the most effective ways to take control of your finances is to create your budget before the month starts. Planning ahead gives you a clear roadmap, reduces stress, and ensures every dollar has a purpose. Instead of reacting to your expenses after they happen, you’ll proactively decide where your money should go.

A simple way to do this is by using a budget calculator. With just a few inputs—your income and estimated expenses—you can see exactly how much to allocate for essentials, savings, and lifestyle spending. By setting these limits before the month begins, you avoid overspending and stay aligned with your financial goals.

If you don’t want to get overthinking about your budget to much I have create a free spreadsheet that you can track all your monthly budget and adjust them freely.

Moreover, if you are a Notion Nerd like me and don’t want to use a classical spreadsheet, i also create a Notion “BUDGETING FOCUS” Template that is design to help you stay organize, track your spending and reach you financial goal in one easy to use workspace.

Final Thought

You don’t have to be perfect—you just have to start. With time, you’ll feel more confident, more organized, and more proud of how you handle your money. You’re capable of creating a life that fits your goals—and your budget is the first step. Keep going—you’ve got this.

NowBetterMONEY, where is a hub shares practical tips on budgeting, saving, and debt management. I uses a personal finance tracker to monitor spending and savings, helping readers take control of their finances and build long-term financial stability with simple, actionable strategies. Author Bio